capital gains tax usa

That is taxed at between 0 to 28 depending on the individuals income and the type of asset. Source capital gains in the hands of nonresident alien individuals physically present in the United States for 183 days or more during the taxable year.

Capital Gains Tax Definition Taxedu Tax Foundation

A flat tax of 30 percent is imposed on US.

. Capital gains taxes on assets held for one year or. While the US does have a federal. They are subject to ordinary income tax rates meaning theyre.

The estate tax exclusion will grow in 2023 to 1292 million from 1206 million in 2022. Taxpayers with modified adjusted gross income. Taxes capital gains as income and the rate reaches 5.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. 2022 federal capital gains tax rates.

The capital gains tax rate is 0 15 or 20 on most assets held for more than one year. As part of this there is a long-term capital gains tax which is a 20 tax on investments held for more than. The capital gains tax on most net gains is no more than 15 for most people.

Short-term capital gains are gains apply to assets or property you held for one year or less. That means that until your estate exceeds 1292 million you will not owe any tax. Your total taxable income after standard deduction and including the gross capital gains goes in box 1.

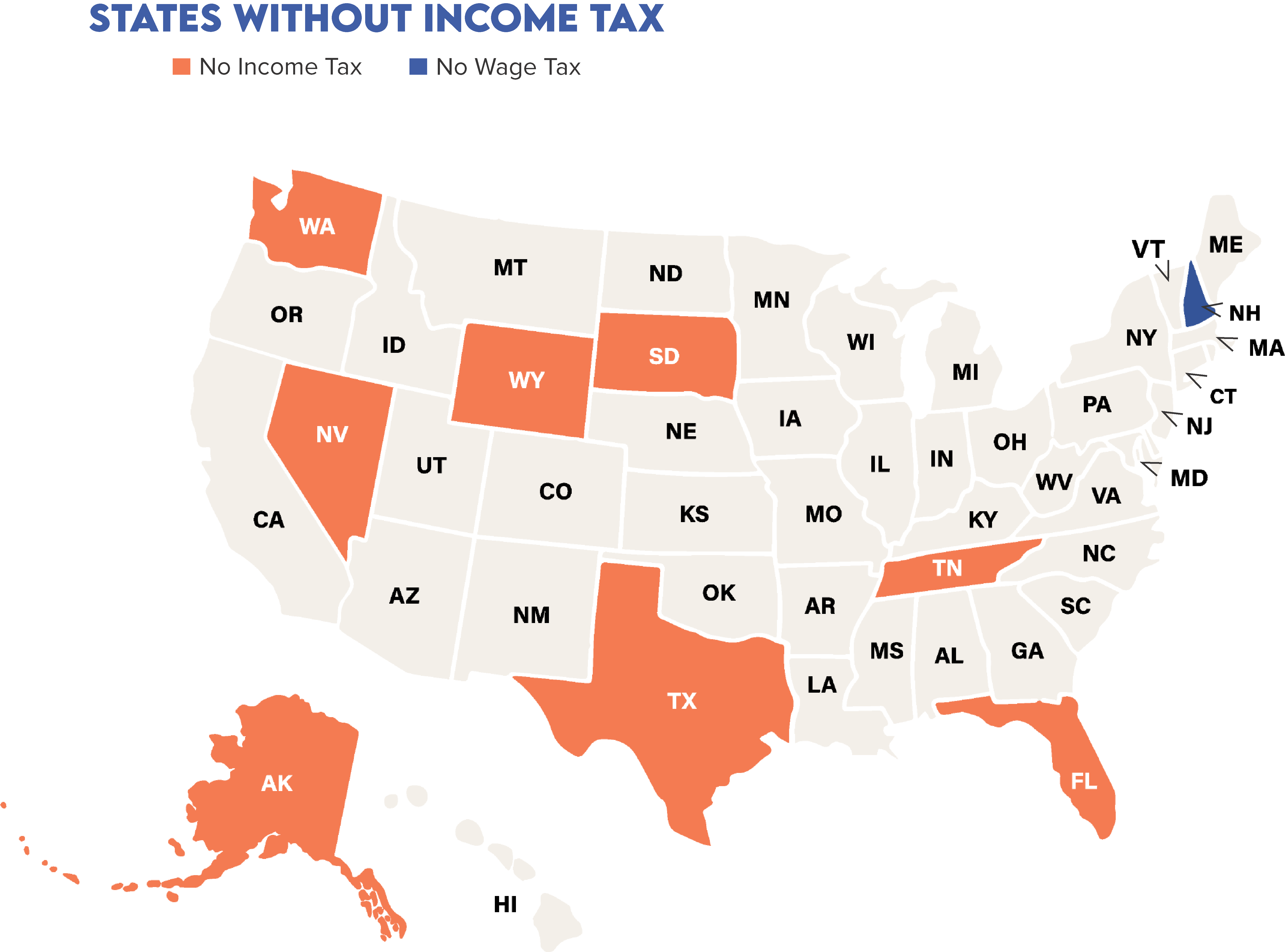

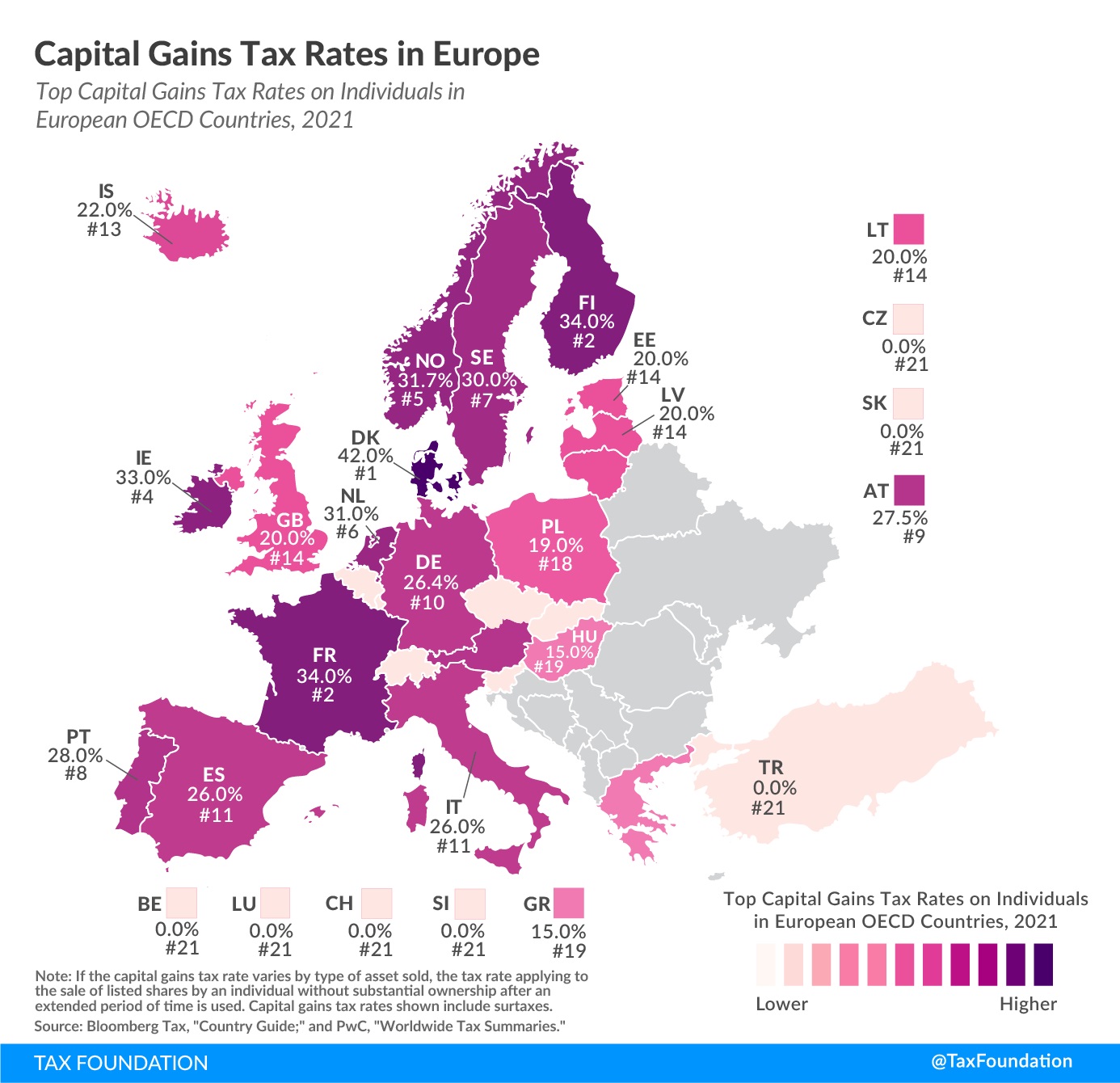

At the state level income taxes on capital gains vary from 0 percent to. For 2023 you may qualify for the 0 long-term capital gains rate with taxable income of 44625 or less for single filers and 89250 or less for married couples filing jointly. Short-term capital gains are taxed as ordinary income at rates up to 37 percent.

In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains. Taxes capital gains as income and the rate reaches 45. Long-term gains are taxed at lower rates up to 20 percent.

Weve got all the 2021 and 2022 capital gains. Just like income tax youll pay a tiered tax rate on your capital gains. Net capital gain or loss is ones total long-term capital gains minus any capital.

20000 is taxed at 0. Taxes capital gains as income and the. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately.

Capital Gains Tax Calculator and Rates 2022-2023. Learn more about who pays capital gains taxes on a deceased estate. Learn more about who pays capital gains taxes on a deceased estate.

The highest-earning people in the United States pay a 238 tax on capital gains. Short-term capital gain tax rates. For example a single person with a total short-term capital gain of.

If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0.

29 Best Capital Gains Tax Ideas Capital Gains Tax Capital Gain Tax

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Taxing Capital Gains As Ordinary Income Jonathan Turley

Tax Calculator Estimate Your Income Tax For 2022 Free

Elimination Of Stepped Up Basis Poses Hazards To Family Farms

Managing Tax Rate Uncertainty Russell Investments

Can Capital Gains Push Me Into A Higher Tax Bracket

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Capital Gains Tax What It Is How It Works And Current Rates

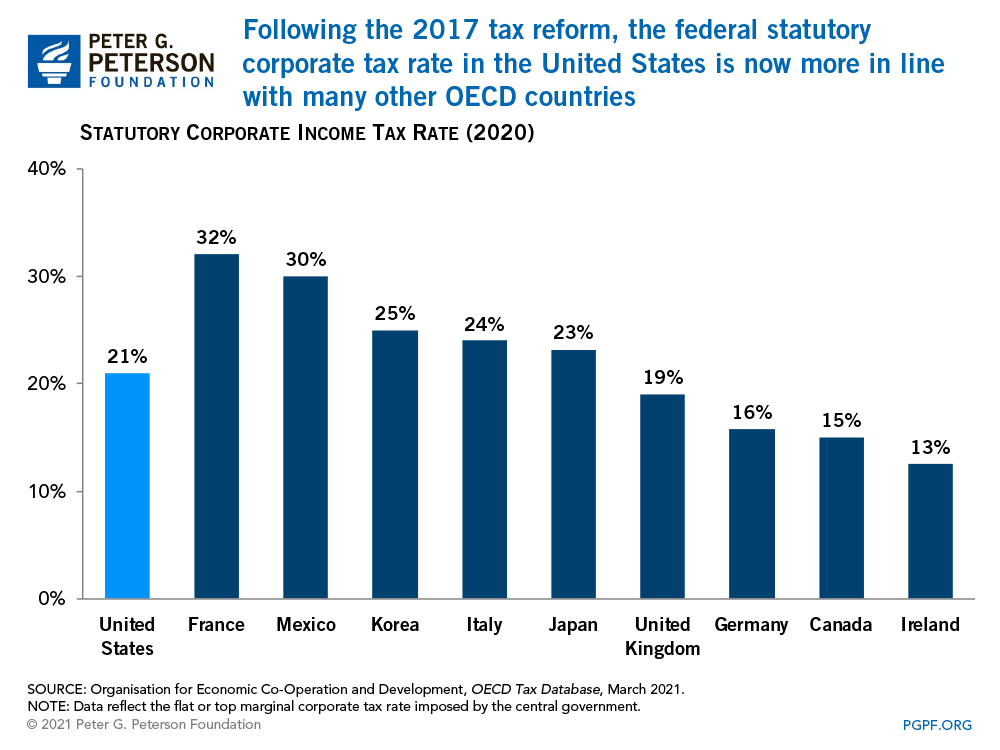

Six Charts That Show How Low Corporate Tax Revenues Are In The United States Right Now

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

The Flight To Tax Free States Investor Tax Advantages

Net Capital Gains Tax Would Approach A Whopping 60 Under Biden S Proposal Mish Talk Global Economic Trend Analysis

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

The Ultimate Crypto Tax Guide 2022 Coinledger

The States With The Highest Capital Gains Tax Rates The Motley Fool

Biden Wants America To Have The World S Highest Tax Burden On Capital Gains International Liberty